Researchers from Glassnode and Ark Invest have collaborated to develop a new economic model for analyzing Bitcoin’s onchain metrics called “Cointime Economics.” The framework offers an alternative way to measure the economic activity and value of bitcoin based on “coinblocks” rather than the standard accounting method of unspent transaction outputs, or UTXOs.

Cointime Economics: A Unique Framework for Analyzing Bitcoin

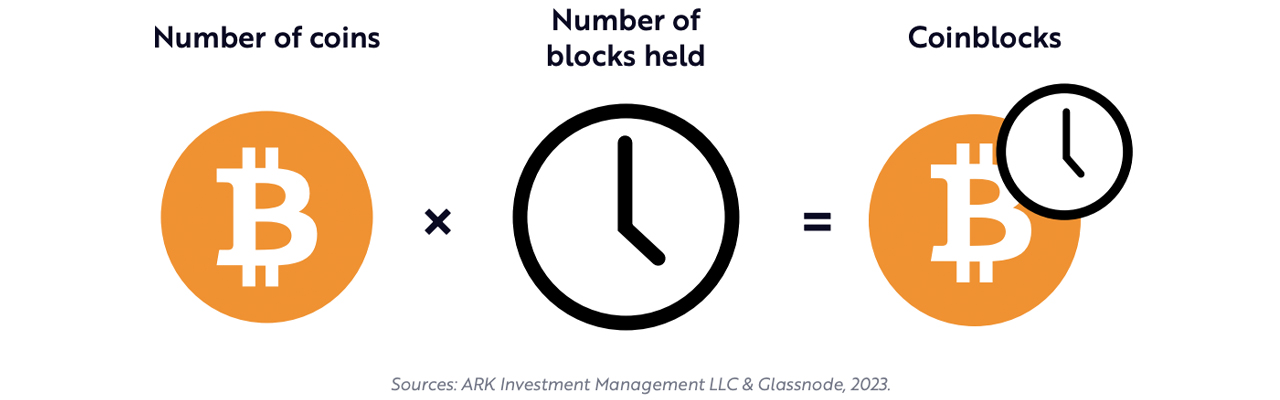

The Cointime Economics white paper explains that coinblocks are the product of the number of bitcoin, or BTC, multiplied by the number of blocks they are held without moving. For instance, ten bitcoins held for ten blocks would equal 100 coinblocks. This method aims to capture the real economic weight and importance of each bitcoin based on the time it remains dormant. The longer a bitcoin is unmoved, the higher its cointime and implied economic significance.

Cointime Economics introduces metrics such as coinblocks created, destroyed, and stored to describe Bitcoin’s economic state over time. It also proposes ratios such as “liveliness,” which measures network activity, and “vaultedness,” which gauges inactiveness. When applied to bitcoin supply, this framework distinguishes between active supply and vaulted supply to assess true inflation and other factors.

According to the researchers, Cointime Economics can enhance existing valuation models like the Market Value to Realized Value, or MVRV ratio by substituting active value and investor value for the traditional market cap and realized cap. They present a modified Active Value to Investor Value, or AVIV, ratio using cointime concepts that might more accurately indicate when BTC is overvalued or undervalued.

The framework also enables new onchain analytics to measure Bitcoin’s volume- and time-weighted cost basis. As an example, the white paper introduces “Cointime Price” as a metric weighing both transaction volume and length of ownership. On May 7, 2023, the Cointime Price was $17,568, considerably below BTC’s market price.

Overall, the researchers believe Cointime Economics offers a consistent way to quantify Bitcoin’s economic activity and importance that takes into account the time coins are stored. They argue metrics based on coinblocks and cointime might provide significant advantages over models relying only on traditional UTXOs and blockchain data.

Authors James Check, the lead analyst at Glassnode, and co-author David Puell, a research associate at Ark Invest, noted that the introduction of this new conceptual framework aims to give analysts more robust tools for evaluating Bitcoin’s onchain fundamentals.

What do you think about Cointime Economics? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/HjvaxCz

0 Comments